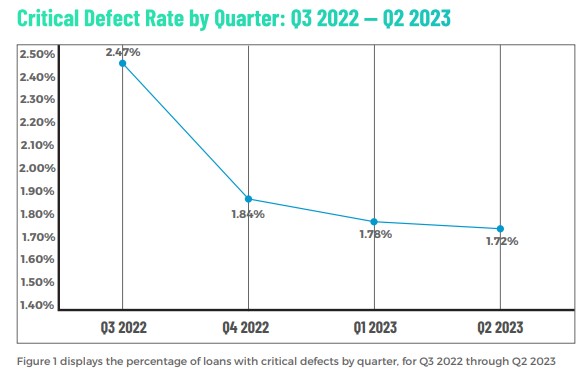

According to a new press release from ACES Quality Management covering second quarter of 2023, the QC Industry Trends Report found that the critical defect rate of mortgages declined for the third quarter in a row.

According to a new press release from ACES Quality Management covering second quarter of 2023, the QC Industry Trends Report found that the critical defect rate of mortgages declined for the third quarter in a row.

Notable findings from the Q2 2023 report include the following:

- The overall critical defect rate decreased by 3.37% to 1.72%, marking the third consecutive quarter of decline.

- Defects in the Credit and Liabilities categories increased for the second straight quarter.

- While Income/Employment and Assets continued to improve, these remain the top two defect categories for Q2 2023, followed by Loan Documentation at No. 3.

- Analysis of the core underwriting sub-categories showed dramatic improvement in Asset Eligibility from Q1, whereas Credit Documentation and Income/Employment quality deteriorated significantly.

- After increasing slightly in Q1, Appraisal defects declined in Q2.

- Q2 marked the third consecutive quarter where purchase and refinance transactions achieved relative defect parity.

- Last quarter’s improvement in FHA defects proved momentary, as defects rose this quarter, outstripping review share. Defects decreased across USDA, VA and conventional loans, with VA loans experiencing the most improvement.

“The downward trend in critical defect rates over the last few quarters speaks to the care lenders are putting into each loan. At a time when every loan originated matters, lenders are taking quality control seriously and doing all they can to prevent buyback requests from the GSEs,” said ACES EVP Nick Volpe. “Critical defect rates continue to trend in the right direction, and now, with interest rates trending down at the time of this report, we’re looking forward to seeing lenders maintain high loan quality as the market once again changes.”

“Our findings for Q2 have been a welcoming of positive news, and with continued predictions for a more robust origination environment in 2024, the future looks bright for lenders that have survived the drop in volume and increased QC scrutiny,” said ACES CEO Trevor Gauthier. “The lenders that have been successful in 2023 are those that have embraced QC and prepared for the next market shift. We’re looking forward to watching lenders continue to keep quality at the forefront of their operations.”

Click here to view the report in its entirety.

DSNews The homepage of the servicing industry

DSNews The homepage of the servicing industry